- Home

- Renault Group exceeds its 2021 targets and accelerates its Renaulution strategy

febbraio 18, 2022 - renault.group

Renault Group exceeds its 2021 targets and accelerates its Renaulution strategy

Comunicato Stampa disponibile solo in lingua originale.

• 2021 financial outlook largely exceeded:

•2021 operating margin: 3.6% (vs. operating margin outlook of the same order as H1 2021 ie 2.8%) reaching, 2 years ahead of schedule, the Renaulution objective of an operating margin above 3% in 2023

• Automotive1 operational free cash flow (FCF) before change in working capital requirement: €1.6bn (vs the positive Automotive operational FCF outlook)

Renaulution objectives achieved in advance, acceleration of the Group's strategy:

Cash fixed cost reduction plan of €2bn compared to 2019 carried out one year ahead of schedule

Reduction of breakeven point2 by 40% compared to 2019, achieved 2 years in advance (initial reduction target of more than 30% by the end of 2023)

Efficiency of the Renaulution commercial policy, which favors value over volumes (price effect at +5.7 points in 2021) and which will continue in 2022

Group orderbook in Europe with more than 3 months of sales, supported by the attractiveness of the Renault E-TECH offer, Arkana, light commercial vehicles, Dacia Sandero and Dacia Spring 100% EV

Continued improvement in 2022 in the product mix and enrichment of vehicles in particular with the launch of Renault Megane E-TECH and Austral, Dacia Jogger

2021 results:

Group revenue at €46.2bn: +6.3% vs. 2020

Group operating margin at €1.7bn (3.6% of revenue): up €2bn vs. 2020, reaching 4.4% in the second half of 2021

Automotive1 operating margin at €507m (1.2% of segment revenue): up €1.8bn vs. 2020 (+4.4 points)

Net income at €967m

Automotive1 operational free cash flow after change in working capital requirement: €1.3bn, contributing to the €2bn reduction in Automotive net debt

In 2021, Renault Group confirms it achieved its CAFE3 targets (passenger cars and light commercial vehicles) in Europe thanks in particular to the performance of its E-TECH4 sales, which represent nearly a third of Renault brand passenger car registrations in Europe (vs. 17% in 2020)

2022 outlook:

In an environment still impacted by the semiconductor crisis, particularly in the 1st half of 2022 (total loss estimated at 300,000 vehicles on 2022 production), and by the increase of raw materials prices, the Group is aiming to achieve for the full year:

• a Group operating margin superior or equal to 4%

• an Automotive operational free cash flow superior or equal to €1 bnAhead of its mid-term Renaulution objectives, the Group will organize a Capital Market Day in the fall of 2022.

"Renault Group largely exceeded its 2021 financial targets despite the impact of semiconductor shortages and rising raw material prices. This reflects the sustained pace of the in-depth transformation of the Group, initiated within the framework of Renaulution. Thanks to the continuous commitment of the teams and by capitalizing on the Alliance, we are accelerating the deployment of our strategic ambitions, in order to position the Group as a competitive, tech and sustainable major player." said Luca de Meo, CEO of Renault Group

"With these 2021 results, Renault Group reached a further step in its recovery. This performance is due to the early successes of the Group strategy, promoting value over volumes, and its strict financial discipline. It allowed us to achieve in a sustainable way, and one or two years in advance, some objectives of Renaulution. The Group is further accelerating the implementation of its strategic projects with the single target of creating value for all its stakeholders." said Clotilde Delbos, CFO of Renault Group

Further information in the press release to download

News correlate |

||

|

Boulogne-Billancourt, October 13, 2022 – Today, #renaultgroup announced the creation of a new entity entirely dedicated to the cir... |

Comunicato Stampa disponibile solo in lingua originale. • Renault Group will be present through its brands Renault and Mobilize, a... |

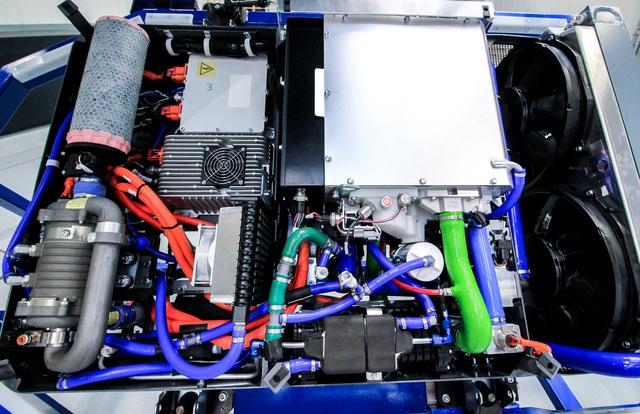

Comunicato Stampa disponibile solo in lingua originale. • Nine months after its creation, HYVIA, the Renault Group and Plug Power’... |

Ti potrebbe interessare anche |

||

|

Comunicato Stampa disponibile solo in lingua originale. Renault Group, #valeo and #valeo #siemens eAutomotive announce that they h... |

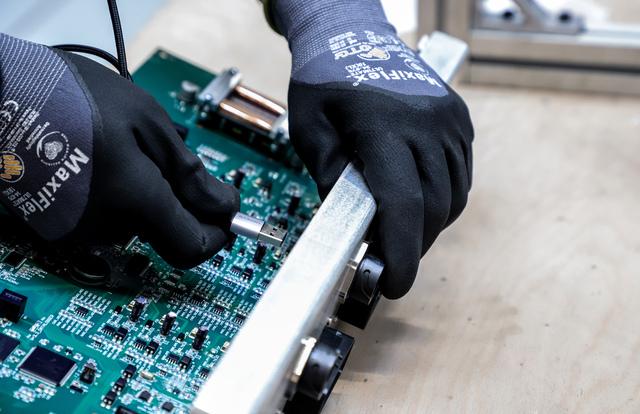

Comunicato Stampa disponibile solo in lingua originale. Alpine #F1 Team is pleased to announce the promotions of #patfry to the ro... |

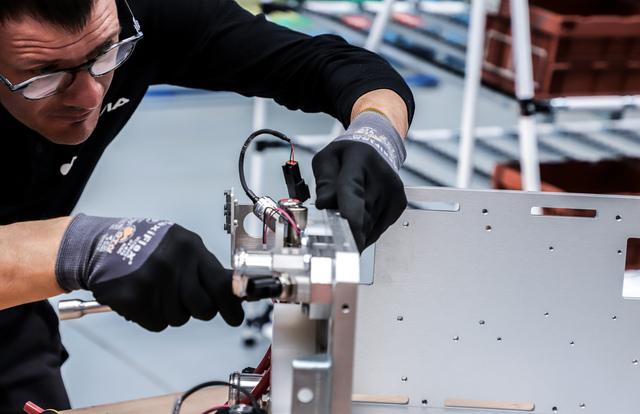

Comunicato Stampa disponibile solo in lingua originale. Renault Group announces the signing of two major partnerships in the field... |

Inglese

Inglese  Condividi

Condividi Condividi via mail

Condividi via mail  Automotive

Automotive Sport

Sport Events

Events Art&Culture

Art&Culture Design

Design Fashion&Beauty

Fashion&Beauty Food&Hospitality

Food&Hospitality Tecnologia

Tecnologia Nautica

Nautica Racing

Racing Excellence

Excellence Corporate

Corporate OffBeat

OffBeat Green

Green Gift

Gift Pop

Pop Heritage

Heritage Entertainment

Entertainment Health & Wellness

Health & Wellness